reit tax advantages canada

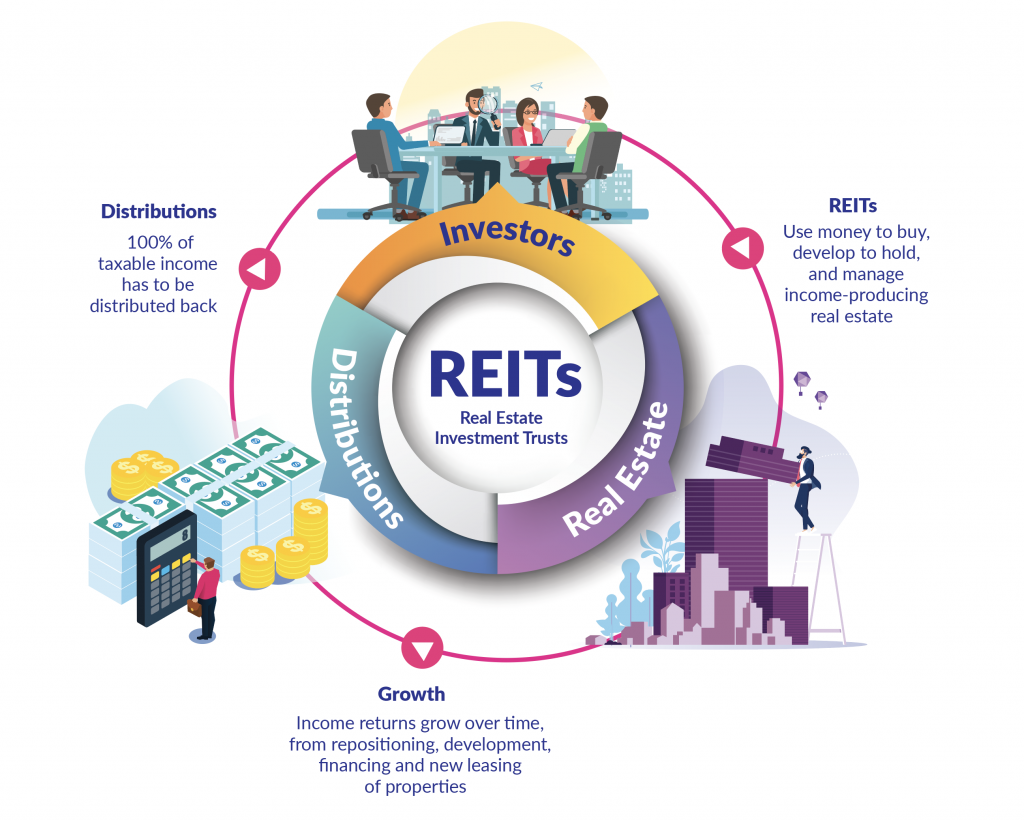

There is no withholding tax on distributions by the REIT to residents of Canada. REITs encourage capital formation and allow small investors to participate in the ownership of all real estate asset types on the same basis as the.

2 Cheap Canadian Reits For Passive Income The Motley Fool Canada

Tax benefits of REITs.

. Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Taxation of Canadian income trusts is special in Canada. Your REIT Income Only Gets Taxed Once.

A notable advantage of REITs is the ability to pay out a portion of distributions that would otherwise be treated as ordinary income as ROC due to real estate. Tax treatment of REIT. Tax Advantages of REITs.

The 293 billion REIT is the lone real estate stock in the cure sector. It owns and operates a portfolio of healthcare real estate infrastructure such as medical office buildings. When a typical corporation makes money it has to pay taxes on its profits.

As REIT dont pay tax on the dividend they tend to offer higher. Wachovia Hybrid and Preferred Securities WHPPSM Indicies. Individual REIT shareholders can deduct.

REITs also pass along tax advantages to unit holders such as expenses and depreciation. REIT Tax Benefits No. Certain non-cash deductions such as depreciation and amortization lower the taxable income for REIT distributions.

Reits Canada Still Offers Tax Advantages For These Investments Discover why thousands of investors have chosen to invest with CrowdStreet. If it pays a dividend to. REITs also pass along tax advantages to unit holders such as expenses and depreciation.

Tax advantage of REITs. REITs offer certain tax advantages to encourage this investment. Market capitalization weighted indicies designed by Wachovia to measure the performance of the.

However income distributions to nonresidents will attract a 25 withholding tax and. How is the REITs market evolving in Canada. In many countries REITs enjoy certain tax advantages for instance in Canada they arent taxed on gains from property and rental incomes as long as they meet certain.

In Canada a REIT is not taxed on income and gains from its property rental. Get your free copy of The Definitive Guide to Retirement Income. Preferential Tax Treatment for Return of Capital Distributions More Favorable Rates on Capital Gains Easier Tax Reporting.

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. REITs are good for the Canadian economy. At this time the 20 rate deduction to individual tax rates on the ordinary.

Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. Entities qualifying for REIT status under the tax code receive preferential tax treatment. A REIT gets the preferential tax treatment of an income trust which means it is not subject to corporate tax.

Reits Canada Still Offers Tax Advantages For These Investments For example if. The income generated by REITs is not taxed on the corporate level. The Tax Advantages of REITs.

Investing In Canadian Reits 2022 Pros Cons Comparison

H R Reit Announces Transformational Strategic Repositioning Plan

Reit Taxation A Canadian Guide

Real Estate Investment Trust Reit How They Work And How To Invest

Investing In Reit Etfs The Motley Fool The Motley Fool Investing The Fool

Reits Canada Still Offers Tax Advantages For These Investments

Investing In Canadian Reits 2022 Pros Cons Comparison

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

Are Reits A Good Investment Wealth Professional

A Short Lesson On Reit Taxation

Reit Taxation A Canadian Guide

Reits Canada Still Offers Tax Advantages For These Investments

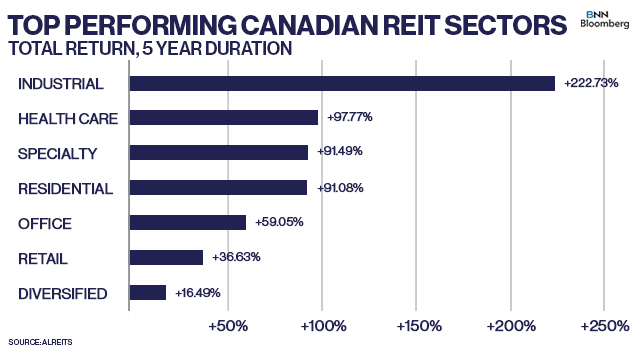

Investing In Reits Top Canadian Reits 2022 The Motley Fool Canada

Investing In Canadian Reits 2022 Pros Cons Comparison

Canadian Reits Vs U S Reits Which Are Better Buys For Canadians The Motley Fool Canada

If Buying A Home Seems Impossible Reits Could Be The Next Best Thing Bnn Bloomberg

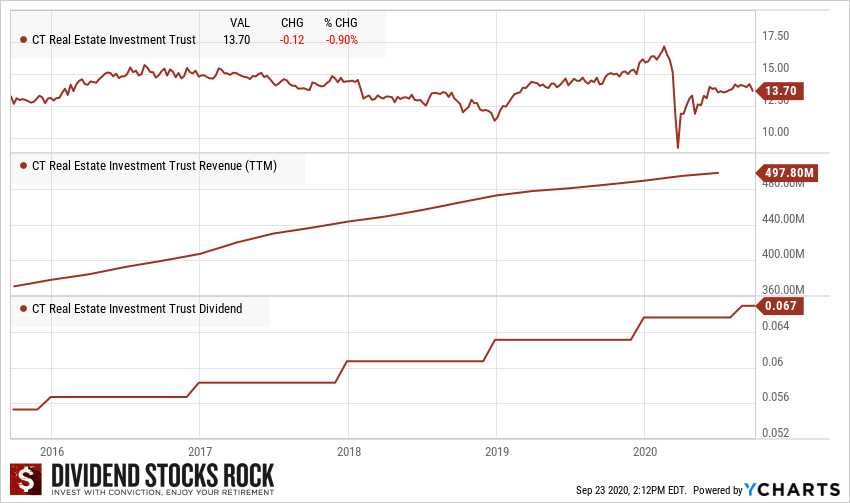

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha